How to Set Goals for Crypto Futures Trading with $1000

When trading in crypto futures, setting clear, realistic goals is essential to manage risks and ensure long-term growth. With $1000, you’re in a better position to make calculated trades, manage risks effectively, and aim for steady profits. In this guide, I’ll walk you through setting daily and weekly profit goals, determining the best times to trade, and developing a strong risk management strategy.

1. Daily Profit Target and Long-Term Growth Strategy

With $1000, aiming for daily profits between 1.5% – 3% is a practical goal. This equates to a daily profit target of $15 – $30. While this might seem like a modest goal, the compounding effect can lead to significant growth over time. The key is to build wealth slowly and consistently without exposing yourself to high-risk trades.

- Daily Profit Target: $15 – $30

- Weekly Profit Target: If you aim for around 2.5% daily profit and successfully meet that target consistently, by the end of the week, you could be making around $100 – $150. This means by the end of one month, your $1000 can potentially grow to $1500 – $1600 (or even more with compounding).

- Avoid Overtrading: Once you’ve hit your daily target, resist the urge to keep trading just because the market is moving. Overtrading can lead to mistakes and bigger risks.

- Stay Consistent: Focus on making small but consistent profits. Some days you might exceed your target, while other days you might fall short. The goal is consistency over time, not winning every single day.

2. Risk Management Strategy

When trading futures, risk management is crucial. Without proper risk management, you could lose your capital very quickly due to the leverage involved in futures trading. A smart strategy is to use only 1-2% of your capital per trade, meaning that for every trade, you should only risk $10 – $20 out of your $1000. This helps protect you from big losses.

- Use Leverage Wisely: While futures trading offers the potential for high profits through leverage, it also magnifies your losses. If you’re just starting, keep leverage low, around 2x to 5x. Higher leverage increases your risk.

- Set Stop-Loss: Always set a stop-loss to protect your position. A stop-loss of around 1-2% of your trade value can help you limit losses. For example, if you open a trade for $100, set a stop-loss that would limit your loss to $1-2. This ensures that one bad trade doesn’t wipe out a large portion of your account.

- Take Profit: Similar to a stop-loss, use a take-profit order. When your trade reaches your profit target (e.g., 2-3%), close it automatically. This helps lock in your gains without letting the market reverse against you.

3. Timing: When to Trade and When to Avoid

Timing plays a significant role in the success of your trades. Crypto markets are open 24/7, but not all hours are equally suitable for trading. Choosing the right time to trade can make a big difference in the price movements and volatility you encounter.

Best Times to Trade:

- High Volatility Periods: The crypto market sees the most movement when major financial markets are open, particularly during the overlap of the U.S. and European markets, typically between 8 AM – 12 PM UTC. This is when the most traders are active, leading to higher volume and larger price movements, which is ideal for futures trading.

- Weekdays vs. Weekends: Weekdays tend to have more liquidity and bigger price movements, making them ideal for futures trading. Avoid trading on weekends, as liquidity is often lower, leading to unpredictable price swings and higher risks.

Times to Avoid:

- Low Liquidity Hours: Trading during the night (depending on your time zone) or during holidays can expose you to unexpected price fluctuations due to lower liquidity. These times are often more volatile and can lead to higher slippage.

- After Major Announcements: Be cautious around major market-moving events, such as regulatory announcements or economic data releases. While these can bring big price movements, they can also cause unpredictable volatility that can trigger your stop-loss too early.

4. Setting Short and Long-Term Goals

It’s important to have both short-term and long-term goals for your trading journey. This helps you track progress and stay motivated without making emotional decisions in the heat of the moment.

Short-Term Goals:

- Daily Goal: Aim for 1.5-3% profit daily, meaning you’d end the day with $15 – $30. Even if the market is slow, reaching your goal is a win.

- Weekly Goal: By compounding daily profits, your weekly target could be $100 – $150. This allows you to maintain a steady rhythm, without being overly aggressive or risking too much.

Long-Term Goals:

- Monthly Goal: A realistic long-term goal might be growing your $1000 into $1500 – $2000 over a month. This depends on your discipline and ability to stick to the plan without letting emotions take over.

5. Monitor Market Sentiment

Understanding the sentiment of the crypto market can give you an edge in futures trading. Positive news such as adoption by large companies, technological advancements, or favorable regulations can push prices higher, while negative news, such as regulatory crackdowns or major hacks, can cause prices to drop.

- Follow News Closely: Stay updated on important market news. Major events like Bitcoin halving, institutional investments, or changes in regulations often create opportunities for big price moves.

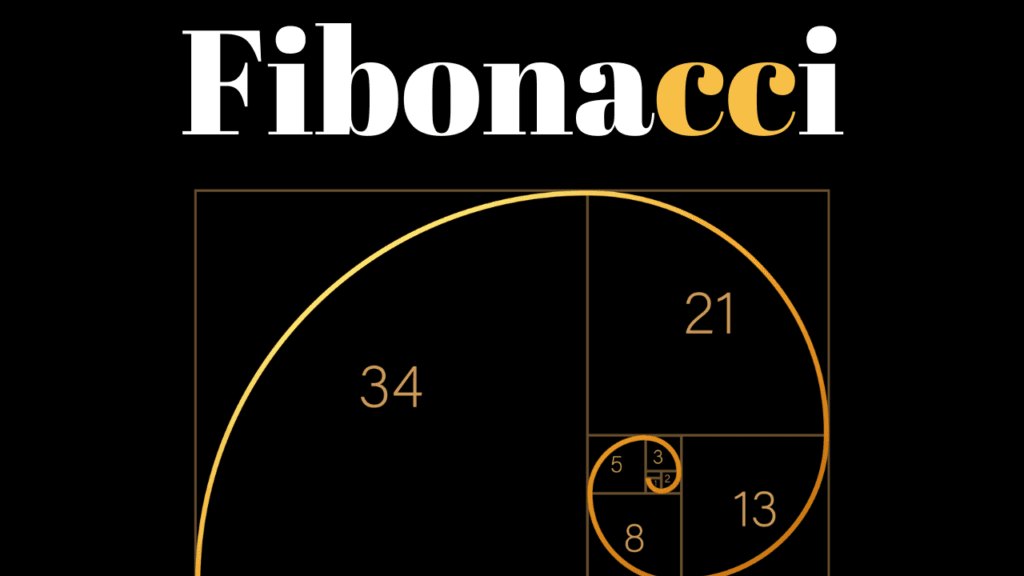

- Use Technical Analysis: Tools like moving averages, RSI (Relative Strength Index), and Fibonacci retracements can help you spot potential entry and exit points in the market. Use these tools to help predict price movements and avoid trading blindly.

6. Tips for Staying Disciplined

Trading discipline is often the difference between successful traders and those who lose their capital quickly. It’s easy to get caught up in the excitement of the market, but sticking to your strategy is key.

- Avoid Emotional Trading: If you make a loss, don’t rush into another trade to “win back” your money. Take a step back and analyze what went wrong. Similarly, don’t overtrade if you’ve had a series of wins. Take profits and be content with hitting your daily goal.

- Keep a Trading Journal: Document each trade, including why you entered, where you set your stop-loss and take-profit, and the outcome. This helps you learn from mistakes and improve over time.

Building a Sustainable Crypto Trading Plan

Trading crypto futures with $1000 can be a rewarding experience if done correctly. By setting realistic daily and weekly profit goals, using strong risk management techniques, and trading at optimal times, you can grow your capital steadily over time. Remember that patience, discipline, and sticking to your plan are the keys to long-term success.

For more crypto trading tips, market analysis, and educational resources, visit Hunnier.com, where we offer all the tools you need to become a confident crypto trader—completely free!