Top 5 Moments That Can Trigger a Bear Market in Crypto

A bear market in the crypto world can feel sudden and disruptive, yet certain events or market conditions often signal its onset. Let’s explore five significant moments that can trigger a bear market in cryptocurrency and understand the mechanics of each.

1. Regulatory Crackdowns

One of the most impactful triggers of a crypto bear market is regulatory action. Governments around the world have been increasingly focused on implementing laws that regulate crypto to protect investors and prevent illegal activities like money laundering. However, sudden or restrictive policies can create market-wide uncertainty, often leading to investor panic and a decline in prices. For example, when China banned crypto mining in 2021, it led to a steep drop in Bitcoin’s price as miners moved their operations abroad. Regulatory crackdowns in major markets like the United States, the European Union, and other global financial hubs can significantly affect crypto asset prices and investor sentiment.

Further regulatory pressure may restrict exchanges or limit certain types of cryptocurrency transactions, thus affecting market liquidity and creating a less favorable trading environment. Investors and companies in the space can react by offloading assets, fearing that tougher restrictions will continue to negatively affect the market.

2. Macroeconomic Events and High-Interest Rates

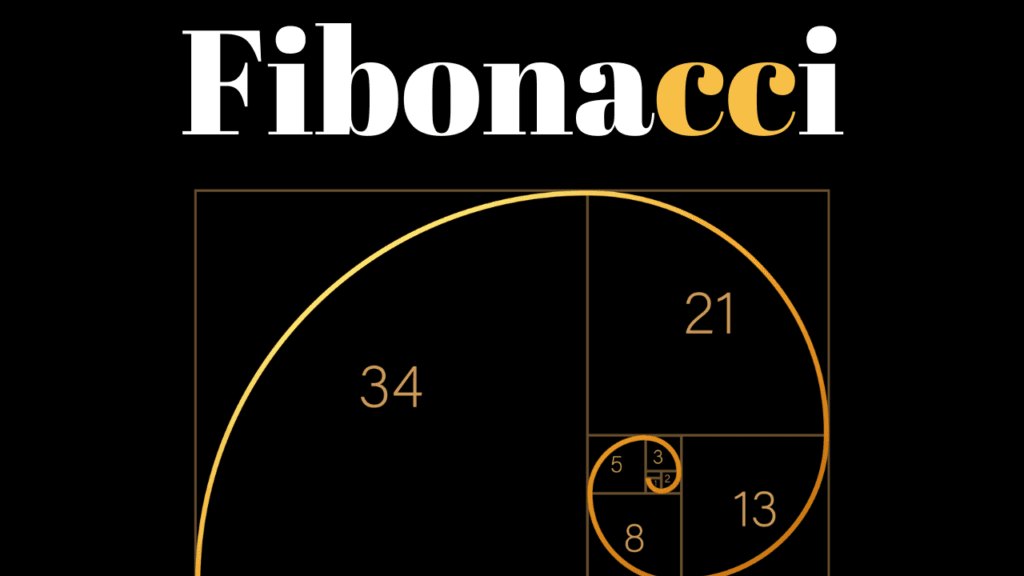

Macro factors, such as global economic downturns or increasing interest rates, can deeply influence the crypto market. During economic uncertainty, institutional and retail investors alike may shift their capital from riskier assets like crypto to more stable options such as bonds or traditional stocks. For example, when the Federal Reserve raises interest rates, as seen in 2022, it often leads to a reduction in investor appetite for volatile assets, including cryptocurrency.

In these scenarios, the high cost of borrowing discourages investment in speculative markets. This is particularly true for leveraged traders in crypto, who may face liquidation risks as prices decline, further accelerating the market’s downturn. Hence, high-interest-rate environments are often correlated with bear markets in crypto and other high-risk asset classes.

3. Security Breaches and Major Hacks

Cryptocurrency markets are still maturing, and security remains a significant concern. Major security breaches or hacks can trigger substantial sell-offs and erode market confidence. When a significant breach occurs, such as the 2016 hack of Bitfinex or the 2018 Coincheck hack, billions of dollars can be lost, which shakes the foundation of trust within the crypto ecosystem.

Beyond the immediate financial loss, a hack can also reveal vulnerabilities in the underlying technology of a blockchain or an exchange. As confidence wanes, investors may pull out funds to minimize risk exposure. Additionally, fear of another breach can prompt stricter regulatory oversight, further influencing a bear market.

4. Excessive Leverage and Liquidations

Leverage trading can amplify returns, but it also introduces greater risk to the crypto market. When markets are bullish, leveraged positions can grow, with traders borrowing funds to increase their exposure to price movements. However, in a market downturn, these leveraged positions can quickly spiral into massive liquidations as prices fall.

A sudden wave of liquidations forces more sell-offs, further pushing prices down and accelerating a bear market. For instance, during the crypto crash in May 2021, billions of dollars were liquidated in hours as Bitcoin and other assets plummeted, exacerbated by over-leveraged positions. This cycle can create a “snowball effect,” where a cascade of liquidations leads to a deep and prolonged bear market.

5. Loss of Institutional Interest

Institutional investment has been a major driver of the crypto market’s growth, with companies like Tesla, MicroStrategy, and others adding Bitcoin to their balance sheets in recent years. However, when these large entities lose interest or start selling their crypto holdings, it can send a negative signal to the market. Institutional pullback can indicate doubts about the market’s long-term stability, and their divestment often triggers retail investors to sell as well.

For example, if major institutions start offloading Bitcoin due to uncertain regulatory environments or poor returns, it may trigger a bear market as the selling pressure mounts. The absence of institutional funds also dries up liquidity, further impacting price stability across the crypto market.

Bear markets in crypto are often triggered by a combination of these factors. Whether it’s regulatory shifts, macroeconomic influences, security issues, leverage cycles, or institutional withdrawal, understanding these triggers helps investors prepare and manage risk during volatile times. For those interested in learning more about the effects of these factors, resources such as Binance’s blog and industry publications provide extensive insights into how market conditions evolve with each new development.

For more details, you can explore sources like Binance Research, which discusses the impact of macroeconomic trends, security breaches, and institutional moves on the crypto market.

External Links

For further reading on the factors that contribute to bear markets in cryptocurrency, explore these informative sources:

- Crypto Market Analysis and Trends

- Binance Research provides in-depth analysis on how macroeconomic factors, security issues, and investor sentiment affect crypto markets. Their articles cover trends that can influence both bull and bear markets in detail.

Binance Research – Market Analysis

- Impact of Regulatory Changes on Crypto

- CoinDesk offers a comprehensive look into recent regulatory developments and how they affect cryptocurrency markets worldwide. Understanding how global policies influence crypto can give insights into bear market triggers.

CoinDesk – Regulatory News

- The Role of Institutional Investment in Crypto

- Messari’s market insights on institutional involvement and crypto investments provide a deeper understanding of how large financial entities impact the market. Read their reports for insights into institutional trends and bear market risks.

Messari – Institutional Investment in Crypto

- Security and Hacks in the Crypto Space

- Chainalysis, a blockchain data platform, explores how major hacks and security breaches impact the crypto market. They also report on how these events affect investor confidence and contribute to market downturns.

Chainalysis – Security and Hacks

- The Effects of Macroeconomic Factors on Cryptocurrency

- Investopedia provides educational content on how interest rates, inflation, and other macroeconomic variables influence crypto prices. A solid resource for understanding external factors that can lead to bear markets.

Investopedia – Macroeconomic Factors and Crypto

These resources provide a broad understanding of the complexities that can trigger a bear market, equipping you with the knowledge to navigate the crypto space more effectively.

Thank you for reading this article on the moments that can trigger a bear market in crypto! If you’re interested in diving deeper into cryptocurrency, finance, and investing, explore more of our articles at Hunnier.com. Our site offers insights on crypto market trends, technical analysis, and personal finance tips to help you stay informed and make smart investment decisions. Don’t miss out on our other valuable resources—head over to Hunnier to keep learning!