What Is Panic Selling in the Stock Market? Why It Happens and How to Avoid It

Panic selling is a phenomenon that occurs when investors start selling off their stocks or other assets en masse due to a sudden fear of loss. This behavior often creates a chain reaction, driving prices even lower and causing more investors to sell in an attempt to cut their losses. While fear in the market is natural, panic selling is typically an emotional, reactive move that can lead to significant financial setbacks. In this article, we’ll examine what causes panic selling, the types of events that trigger it, and the strategies investors can use to protect themselves from making impulsive decisions during market downturns.

1. What Is Panic Selling?

1.1 Definition and Characteristics

Panic selling refers to the mass selling of securities, often resulting in a sharp decline in prices. It’s a reaction fueled by fear and uncertainty, where investors choose to exit their positions to avoid potential losses rather than making logical, long-term investment decisions. This often leads to steep declines in stock prices across markets or sectors, as everyone rushes to sell at the same time.

During periods of panic selling, the market can experience increased volatility, sharp price swings, and abnormal trading volumes. For instance, Black Monday, which occurred on October 19, 1987, is one of the most famous examples of panic selling, where the stock market lost 22.6% of its value in a single day. Events like this illustrate the powerful role that fear and psychology play in the stock market.

For a more detailed look at the impact of fear on financial markets, check out this article from Investopedia, which explains how investor emotions can drive market cycles.

2. Why Does Panic Selling Happen?

Panic selling usually occurs when a combination of factors creates a sense of overwhelming fear among investors. Here are some key reasons that trigger panic selling in the stock market:

2.1 Economic Uncertainty

Economic factors, such as an unexpected recession, rising inflation, or high unemployment, can create uncertainty about the market’s future. When investors see these negative indicators, they may start to fear that the value of their investments will decline, prompting them to sell quickly. For example, during the 2008 financial crisis, widespread panic selling happened as people worried about the future of the global economy.

2.2 Negative News and Events

News headlines can have a major influence on investor behavior. Announcements about financial scandals, wars, geopolitical tensions, or natural disasters often create fear and uncertainty, leading investors to offload their stocks to avoid potential losses. For example, the COVID-19 pandemic triggered massive panic selling in early 2020 when the scale and impact of the virus became evident.

For further insights on how news events impact investor psychology, read this resource on CNBC’s market psychology.

2.3 Market Corrections and Bear Markets

A market correction is a decline of 10% or more in the price of a stock, index, or other investment, while a bear market represents a 20% or more decline. When the market enters a correction or bear phase, many investors fear further declines and try to exit the market to preserve their capital, often leading to a downward spiral in prices.

2.4 Herd Mentality

Investors often follow the crowd, a behavior known as herd mentality. When they see others selling off their stocks in large volumes, they may feel pressured to do the same to avoid missing out on potential gains from selling early. This can lead to a cycle of more selling, ultimately pushing prices lower.

3. When Does Panic Selling Occur?

Panic selling usually happens during periods of extreme market volatility, often in response to one or more of the triggers mentioned above. Here are some common scenarios:

- Economic Recessions: As the economy contracts, people lose confidence in future profits and react by selling their holdings to avoid prolonged losses.

- Market Bubbles and Crashes: After rapid price increases driven by speculative buying, the market can experience a bubble burst. When the bubble bursts, a sharp decline often follows, leading to widespread panic selling.

- Earnings Season: Quarterly earnings reports can sometimes trigger panic selling if companies report poor earnings or weak forecasts. Investors who rely on positive earnings to support stock values may sell when they see disappointing results.

- Interest Rate Changes: Central banks, like the Federal Reserve, influence the stock market by raising or lowering interest rates. In times of high inflation, for example, when central banks raise rates, it can lead to panic selling as the cost of borrowing rises and profit margins tighten.

4. The Consequences of Panic Selling

4.1 Financial Losses

When investors panic sell, they often lock in significant losses that might have been avoidable. Selling at a market low prevents them from benefiting from potential rebounds. Historically, markets have shown a strong ability to recover over time. For instance, after the 2008 financial crisis, the market eventually rebounded and even exceeded previous highs.

4.2 Emotional and Psychological Strain

Panic selling can be emotionally draining, as investors watch their portfolios lose value rapidly. The stress of seeing prices drop and the fear of further losses can cause anxiety and stress, often leading to hasty decisions that may not align with an investor’s long-term strategy.

Understanding the psychology behind panic selling is essential for investors. Learn more about the emotional side of investing in this article by Forbes.

4.3 Lost Opportunities

Panic selling can result in lost opportunities for long-term gains. Investors who sell at market lows miss out on potential rebounds and the compounding growth that could come from staying invested. Time in the market has historically proven to be more profitable than trying to time the market.

5. How to Avoid Panic Selling

Avoiding panic selling requires discipline, a clear understanding of investment goals, and strategies to manage emotions. Here are some proven methods to help investors stay calm during market downturns:

5.1 Have a Long-Term Investment Plan

Building a solid investment plan with clear goals and a long-term perspective helps investors avoid reacting to short-term market fluctuations. A well-structured plan should take into account risk tolerance, investment horizon, and diversification. By staying focused on long-term goals, investors are less likely to be swayed by temporary market movements.

5.2 Diversify Your Portfolio

Diversification across asset classes, sectors, and geographic regions can help reduce risk and limit exposure to any single market event. A diversified portfolio is more likely to withstand periods of volatility, providing stability during market downturns. For example, holding both stocks and bonds can reduce the impact of stock market declines on your portfolio.

5.3 Avoid Checking Your Portfolio Frequently

Constantly checking your portfolio can amplify anxiety, especially during times of market volatility. By reducing the frequency with which you review your investments, you may be less likely to react impulsively to short-term declines. Many successful investors recommend reviewing your portfolio quarterly or even annually rather than daily.

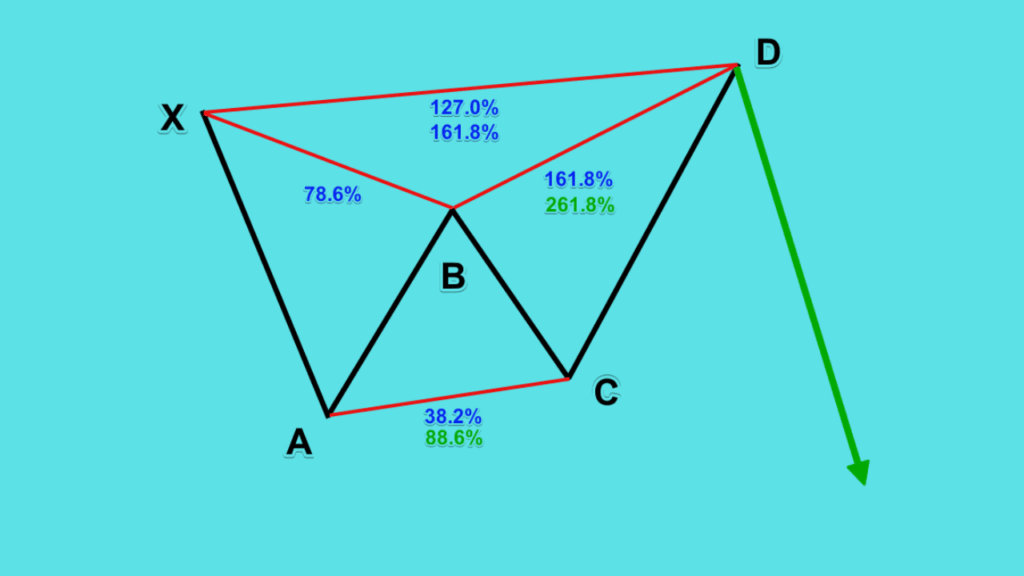

5.4 Set Stop-Loss Orders

A stop-loss order automatically sells a security when it reaches a specific price, limiting potential losses. While stop-loss orders won’t prevent losses entirely, they can help investors limit the downside and avoid the emotional toll of panic selling. For example, if you set a stop-loss at 10% below your purchase price, you’ll sell before a further decline occurs.

5.5 Stay Informed But Rational

Staying informed about economic events and market trends is important, but it’s equally essential to interpret the news rationally. While it’s natural to feel nervous during periods of volatility, try to remember that the market has historically rebounded from downturns. Consulting reputable financial sources can provide a balanced perspective that helps counter fear-driven decisions.

For more on how to keep a rational perspective during market declines, refer to this guide from MarketWatch.

5.6 Practice Emotional Discipline

Controlling emotions during market downturns is challenging, but investors can benefit from practicing mindfulness or seeking advice from financial advisors. Recognizing and managing emotions, especially fear and anxiety, can prevent impulsive decisions. Some investors find it helpful to write down their investment goals and revisit them during turbulent times as a reminder to stay focused.

5.7 Consult a Financial Advisor

If you find it difficult to remain calm during market volatility, consider working with a financial advisor. Advisors can provide professional guidance, helping you make informed decisions and stay focused on your long-term plan. They can also recommend strategies tailored to your risk tolerance and financial goals.

Panic selling is a common phenomenon in the stock market, often triggered by fear and uncertainty. While it may seem like a logical decision to sell during market downturns, panic selling can lead to substantial financial losses and missed opportunities. By understanding the causes of panic selling, investors can take proactive steps to avoid it. Developing a long-term investment plan, diversifying assets, and practicing emotional discipline are key to maintaining stability in volatile markets.

For further information on managing emotions during market volatility, check out reputable resources such as NerdWallet and The Balance

Thank you for taking the time to read our article! We hope it gave you valuable insights into understanding and managing panic selling in the stock market. If you found this helpful, we invite you to explore more articles on our site, where we cover a range of topics that can deepen your knowledge about investing, finance, and market strategies.

Visit Hunnier to read more, and stay connected for the latest insights and tips that can help you make informed decisions and grow in the world of finance.