Understanding IPOs

An Initial Public Offering (IPO) is one of the most exciting and transformative events in the life of a company. It’s a process that allows a private company to go public by selling shares to the general public for the first time, providing access to capital and a chance for investors to participate in its growth. In this article, we’ll explore the intricacies of IPOs, how they work, and how you can participate in them.

Table of Contents

- What Is an IPO?

- How Does an IPO Work?

- Reasons Why Companies Go Public

- The Process of Going Public

- Benefits and Risks of Investing in IPOs

- How to Invest in IPOs

- Common IPO Terms Explained

- Famous IPO Examples and Their Impact

- Final Thoughts on IPOs

1. What Is an IPO?

An Initial Public Offering, or IPO, is the process by which a private company becomes a publicly traded company by offering its shares to the general public for the first time. Before an IPO, a company is typically privately owned, with shares held by founders, private investors, and perhaps a small group of employees. An IPO transitions this private ownership into public ownership, opening the company’s shares to new investors and allowing it to be listed on a stock exchange, such as the New York Stock Exchange (NYSE) or NASDAQ.

Why It’s Called an “IPO”

The term “Initial Public Offering” captures the essence of the process: the initial or first offering of a company’s stock to the public. After an IPO, the company’s shares are available for public purchase, meaning anyone can buy and sell the company’s stock on the open market.

2. How Does an IPO Work?

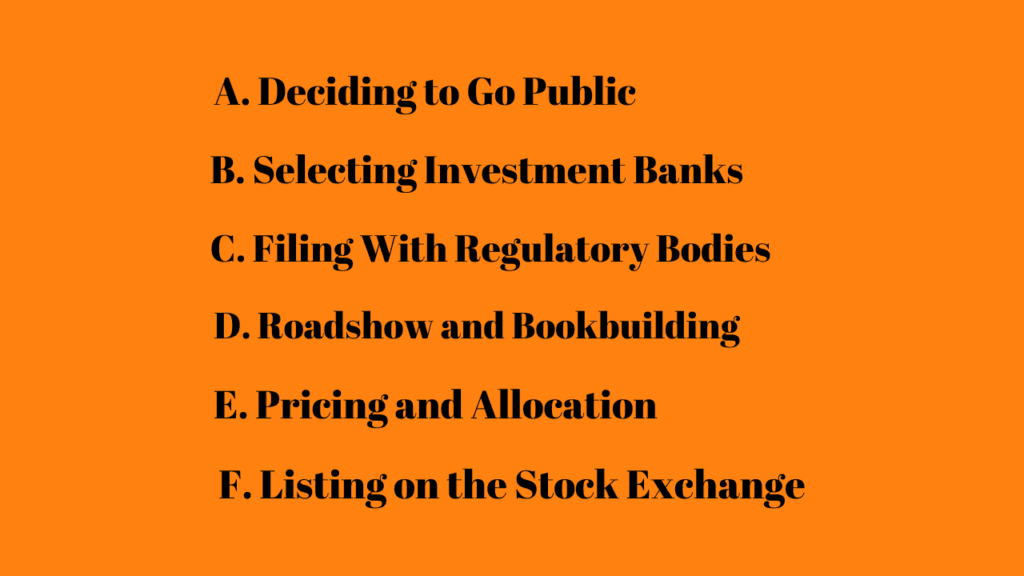

The IPO process involves several key stages, including planning, filing necessary paperwork, marketing the stock, and ultimately, offering the shares to the public. Here’s a look at each step:

A. Deciding to Go Public

A company’s management and board of directors decide to take the company public. This decision is often based on the desire to raise capital, increase visibility, or offer liquidity to its founders and investors.

B. Selecting Investment Banks

The company hires investment banks, also known as underwriters, to guide the IPO process. These banks help set the IPO price, determine the number of shares to offer, and market the IPO to potential investors.

C. Filing With Regulatory Bodies

In the United States, the company must file a registration statement with the Securities and Exchange Commission (SEC), which includes a detailed financial report, a description of the company’s business model, and an explanation of potential risks.

- External Link for Reference: SEC.gov: IPO Registration

D. Roadshow and Bookbuilding

The investment banks and company executives go on a “roadshow” to promote the IPO to institutional investors, like mutual funds and pension funds. This is part of a process called “bookbuilding,” which involves gathering feedback from investors to help set a final price for the IPO shares.

E. Pricing and Allocation

Based on investor interest and market conditions, the IPO price is set. The shares are allocated to various investors, often with a priority on institutional investors, though individual investors may also have a chance to buy shares.

F. Listing on the Stock Exchange

Once all preparations are complete, the company’s shares are officially listed on a stock exchange. From that point on, shares can be bought and sold by the public, and the company has successfully “gone public.”

3. Reasons Why Companies Go Public

Companies pursue IPOs for various strategic reasons, including:

- Raising Capital: By selling shares to the public, companies can raise significant funds to fuel expansion, research, and development.

- Enhancing Brand Reputation: A public listing can increase the company’s visibility, credibility, and brand reputation.

- Providing Liquidity: IPOs offer an exit strategy for early investors and founders, allowing them to sell their shares.

- Access to Future Funding: Public companies often find it easier to raise additional capital through secondary offerings or debt issuance.

Example

Facebook’s 2012 IPO raised over $16 billion, enabling the company to fund its growth and expand its business.

4. The Process of Going Public

The journey to an IPO is complex and involves regulatory scrutiny, financial disclosures, and extensive planning. Here’s a closer look at the steps involved in going public.

A. Due Diligence

Before going public, a company undergoes a thorough review of its financials, operations, and legal matters to ensure everything is in order.

B. SEC Filings and Approval

After conducting due diligence, the company files a registration statement with the SEC. The SEC reviews the filing and may require additional information or clarification.

- External Link for Reference: SEC’s Role in the IPO Process

C. Pricing and Market Demand Assessment

The investment bank assesses demand for the stock and works with the company to set an appropriate IPO price. The price must balance the company’s need to raise capital with investors’ desire for a return.

D. Roadshow Presentations

The roadshow is an opportunity for the company to present its story to potential investors. This is crucial, as it can impact the initial demand for the stock.

E. IPO Launch Day

On the IPO date, the company’s shares are available for trading on the stock exchange. Investors can buy and sell shares, and the stock price fluctuates based on market demand.

5. Benefits and Risks of Investing in IPOs

Benefits

- Potential for High Returns: IPOs can offer substantial returns, especially for early investors.

- Access to Growth Companies: Many IPOs involve fast-growing companies in sectors like technology, healthcare, or renewable energy.

- Liquidity for Early Investors: IPOs provide a way for founders and early investors to monetize their shares.

Risks

- Volatility: IPO stocks can be highly volatile and experience large price swings.

- Limited Historical Data: With no track record as a public company, investors may find it challenging to assess its true value.

- Lock-Up Periods: Early investors and insiders are often subject to lock-up periods, meaning they cannot sell their shares immediately after the IPO.

- External Link for Reference: Investopedia: Risks of IPO Investing

6. How to Invest in IPOs

If you’re interested in investing in IPOs, there are several steps to follow:

- Do Your Research: Study the company’s financials, management, and growth prospects.

- Check Your Brokerage’s IPO Access: Some brokers provide access to IPOs for individual investors.

- Consider Risks and Volatility: IPOs can be unpredictable; make sure you’re prepared for potential price swings.

- Decide on a Long-Term or Short-Term Strategy: Determine if you’re investing for short-term gains or a long-term position.

Example of IPO Investing

When Alibaba went public in 2014, its shares were offered at $68. However, due to high demand, the stock surged, providing strong returns for early investors.

- External Link for Reference: NASDAQ: How to Invest in IPOs

7. Common IPO Terms Explained

Underwriter: Investment banks that help a company prepare for and conduct an IPO.

Lock-Up Period: A period after the IPO during which insiders cannot sell their shares.

Prospectus: A detailed document providing financial and operational information about the company.

8. Famous IPO Examples and Their Impact

A. Google’s IPO

Google’s 2004 IPO was a landmark event, raising $1.9 billion and setting a high bar for future tech IPOs.

B. Amazon’s IPO

Amazon’s 1997 IPO offered shares at just $18, and today, it’s one of the largest companies in the world. Investors who bought shares early have seen massive returns.

9. Final Thoughts on IPOs

Investing in IPOs can be rewarding but also comes with risks. While IPOs provide a way to participate in a company’s growth, they often come with price volatility and uncertainty. By researching each IPO thoroughly and understanding the associated risks, you can make informed decisions that align with your financial goals.

This guide aims to equip you with the knowledge needed to navigate IPOs effectively. As always, make sure to consider seeking advice from a financial advisor for more personalized insights into IPO investing.

Thank you for reading! If you’re interested in exploring more about investing and the stock market, check out some of our other articles:

- What is Decentralized Finance? – Discover the world of DeFi and how it’s transforming traditional finance.

- Top 5 Moments to Start a Bull Market – Learn the key events that can spark a crypto bull run.

- Guide to Candlestick Patterns – Dive deeper into technical analysis with our Candlestick School.

Stay informed and gain more insights with our growing collection of easy-to-understand financial articles.

Oh nice Article 🙌 great work hunnier team