Bitcoin Price Prediction for 2025: A Comprehensive Analysis

Bitcoin (BTC) has been the pioneer of the cryptocurrency world, and its price movements often dictate the overall direction of the crypto market. As we look toward 2025, many investors, analysts, and enthusiasts are speculating about what the future holds for Bitcoin’s price. In this article, we will dive deep into the factors that could influence Bitcoin’s price, past trends, expert predictions, and potential scenarios for 2025.

A Brief History of Bitcoin’s Price Movement

To understand where Bitcoin might be headed in 2025, it’s important to first review its price history:

- Early Days (2009–2013): Bitcoin was created in 2009 by an anonymous person (or group) using the pseudonym Satoshi Nakamoto. Initially, its value was almost zero, and only a handful of enthusiasts saw its potential. By 2011, Bitcoin crossed the $1 mark for the first time. Between 2011 and 2013, it surged to about $1,000, marking its first major bull run.

- The 2017 Boom: Bitcoin gained widespread attention in 2017 when it skyrocketed from about $1,000 at the start of the year to nearly $20,000 in December. This bull run was fueled by mainstream media coverage, increasing adoption, and the launch of Bitcoin futures.

- Crash and Recovery (2018–2020): After reaching its peak in late 2017, Bitcoin experienced a sharp decline, dropping to around $3,000 in early 2018. However, it slowly recovered over the next few years, trading between $5,000 and $10,000 until 2020.

- 2021 Bull Market: In 2021, Bitcoin reached new all-time highs, fueled by institutional interest, growing mainstream adoption, and major companies like Tesla buying Bitcoin. By November 2021, Bitcoin hit an all-time high of nearly $69,000 before entering a bearish phase.

- 2022 Bear Market: In 2022, Bitcoin, along with the rest of the cryptocurrency market, faced a significant downturn due to macroeconomic factors like inflation, interest rate hikes, and regulatory concerns. It fell back to around $20,000 by the end of the year.

Factors That Could Impact Bitcoin’s Price in 2025

Several key factors are likely to shape Bitcoin’s price in the coming years, including market demand, regulatory developments, technological advancements, and macroeconomic conditions. Here are some of the most critical factors that could influence Bitcoin’s price by 2025:

1. Bitcoin Halving Event in 2024

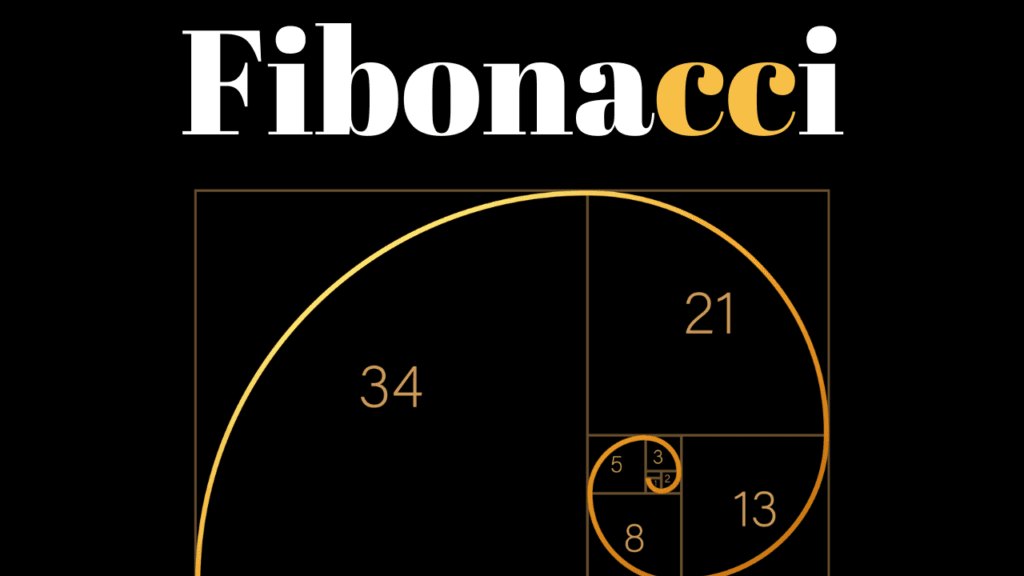

One of the most significant events that will impact Bitcoin’s price before 2025 is the Bitcoin halving scheduled for April 2024. This event occurs roughly every four years and reduces the reward miners receive for validating Bitcoin transactions by half. As a result, the supply of new Bitcoin entering the market decreases, which typically leads to an increase in price due to scarcity.

- Historical Impact of Halvings: After the halving in 2016, Bitcoin’s price surged from around $650 to nearly $20,000 by the end of 2017. Similarly, after the 2020 halving, Bitcoin saw a massive rally that led it to new highs in 2021. If history repeats itself, the 2024 halving could set the stage for another significant price rally in 2025.

2. Institutional Adoption

Institutional interest in Bitcoin has been growing steadily, with companies like MicroStrategy and Tesla holding large amounts of BTC on their balance sheets. Investment firms, hedge funds, and even pension funds are beginning to allocate portions of their portfolios to Bitcoin as a hedge against inflation and fiat currency devaluation.

- Bitcoin ETFs: The approval of Bitcoin Exchange-Traded Funds (ETFs) in countries like Canada and Brazil has made it easier for institutional investors to gain exposure to Bitcoin. In the U.S., the potential approval of a spot Bitcoin ETF by 2025 could further boost institutional demand and drive up the price.

- Corporate Treasury Reserves: More companies may follow in the footsteps of MicroStrategy and Tesla, using Bitcoin as part of their treasury reserves. As more large corporations hold Bitcoin, it could lead to significant price appreciation.

3. Regulation

Cryptocurrency regulation will be one of the key factors determining Bitcoin’s future. Governments around the world are actively working on creating frameworks for regulating digital assets. While some regulation may create hurdles, clear and consistent regulatory frameworks could also boost Bitcoin’s price by providing legitimacy and encouraging further institutional adoption.

- U.S. Regulation: The U.S. is one of the most important markets for Bitcoin. The SEC’s stance on Bitcoin ETFs, taxation, and compliance requirements could have a significant impact on the price. If the U.S. adopts favorable crypto regulations, it could drive a new wave of institutional investment into Bitcoin.

- Global Regulation: Other regions, including the European Union, China, and India, will also play a role in shaping Bitcoin’s regulatory landscape. While China has banned crypto mining, other countries like El Salvador have embraced Bitcoin as legal tender. These diverse approaches will affect global demand and price.

4. Global Economic Conditions

Macroeconomic factors, such as inflation, interest rates, and global economic stability, will have a profound effect on Bitcoin’s price by 2025. In uncertain economic times, Bitcoin is increasingly being viewed as a hedge against inflation and a store of value.

- Inflation Hedge: With rising inflation rates in many countries, Bitcoin’s fixed supply of 21 million coins makes it an attractive option for investors looking to preserve their wealth. If inflation continues to rise in the coming years, Bitcoin’s price could benefit from increased demand as a store of value.

- Recession and Market Volatility: In times of economic uncertainty or a global recession, Bitcoin may either serve as a safe haven asset or, conversely, see decreased demand due to the high risk involved in crypto investments. Investors’ appetite for risk will play a key role in determining Bitcoin’s price during periods of economic turmoil.

5. Technological Development

Bitcoin’s technological upgrades, such as the Lightning Network and improvements in blockchain scalability, could help increase adoption and drive demand.

- Lightning Network: This Layer 2 payment protocol allows faster and cheaper Bitcoin transactions, making it more practical for everyday use. Wider adoption of the Lightning Network by 2025 could make Bitcoin more attractive for microtransactions and boost its price.

- Smart Contracts and DApps: While Bitcoin is not known for its smart contract capabilities like Ethereum, developments in Sidechains or other solutions could expand Bitcoin’s functionality and attract more users and developers.

Bitcoin Price Predictions for 2025

Now that we’ve explored the key factors that could influence Bitcoin’s price, let’s take a look at the various predictions for 2025.

1. Conservative Estimate: $100,000

Some analysts predict that Bitcoin could reach $100,000 by 2025. This estimate assumes moderate growth in institutional adoption, increased interest in Bitcoin as a hedge against inflation, and a successful Bitcoin halving event in 2024.

- Reasoning: A more gradual rise in Bitcoin’s price, driven by increasing demand from retail and institutional investors, combined with continued technological improvements.

2. Optimistic Estimate: $250,000

In a more optimistic scenario, Bitcoin could reach $250,000 by 2025. This projection is based on the assumption that institutional adoption accelerates rapidly, more countries adopt Bitcoin as legal tender, and the 2024 halving sparks a major bull run.

- Reasoning: Bitcoin could become a dominant store of value, similar to gold, with a market cap approaching several trillion dollars. Additionally, the rise of Bitcoin ETFs and favorable regulatory developments could lead to a surge in demand.

3. Extreme Bullish Case: $500,000 or More

Some Bitcoin bulls, such as Cathie Wood of ARK Invest, have made bold predictions, suggesting that Bitcoin could reach as high as $500,000 or even $1 million by 2025. These predictions assume that Bitcoin becomes a global reserve currency and is widely adopted by both institutions and governments.

- Reasoning: In this scenario, Bitcoin would be widely regarded as a safer asset than fiat currencies, with global adoption increasing dramatically. Large-scale investments by governments and corporations could push the price to new heights.

4. Bearish Case: $30,000–$50,000

In a bearish scenario, Bitcoin’s price could fall to $30,000–$50,000 by 2025. This outcome could be caused by adverse regulatory developments, a lack of institutional adoption, or a global economic recession that reduces risk appetite.

- Reasoning: In this case, Bitcoin would still hold value but fail to gain the level of adoption necessary to reach new highs. However, it would likely remain a valuable asset for long-term investors.

What Lies Ahead for Bitcoin in 2025?

Bitcoin’s price prediction for 2025 is highly speculative, as it depends on numerous factors, including regulatory developments, institutional adoption, macroeconomic trends, and technological improvements. While estimates range from $30,000 to over $500,000, one thing is clear: Bitcoin will continue to play a significant role in the global financial system.

As with any investment, it’s important to do thorough research and consider the risks involved. Whether you’re a long-term holder or a newcomer to the space,