10 Simple Budgeting Hacks

Saving money can seem like a challenge, especially with so many daily expenses to keep up with. But with a few smart budgeting hacks, you can start saving more every month without feeling overwhelmed. Budgeting isn’t about restricting yourself; it’s about gaining control over your money and making it work for you. Here are ten practical, easy-to-follow tips that can help you stretch your dollars further and keep more in your savings.

1. Track Your Spending

The first step in any good budget is knowing exactly where your money goes. Tracking your spending means keeping tabs on every dollar you spend, whether it’s on groceries, utilities, or your morning coffee. By monitoring your spending, you’ll quickly see which areas are draining your money the most. There are plenty of apps and tools that make it easy to track your expenses, or you can simply jot them down in a notebook. Once you know where your money goes, you’ll be in a better position to make adjustments and cut unnecessary costs.

2. Set Clear and Realistic Financial Goals

Before you start cutting back, it’s essential to know why you’re saving. Are you saving for a vacation? Building an emergency fund? Paying off debt? Setting clear financial goals helps you stay focused and motivated. Make sure your goals are specific and realistic. For example, instead of saying, “I want to save more,” set a goal like, “I want to save $200 each month.” Having a specific target helps you plan better and stay committed.

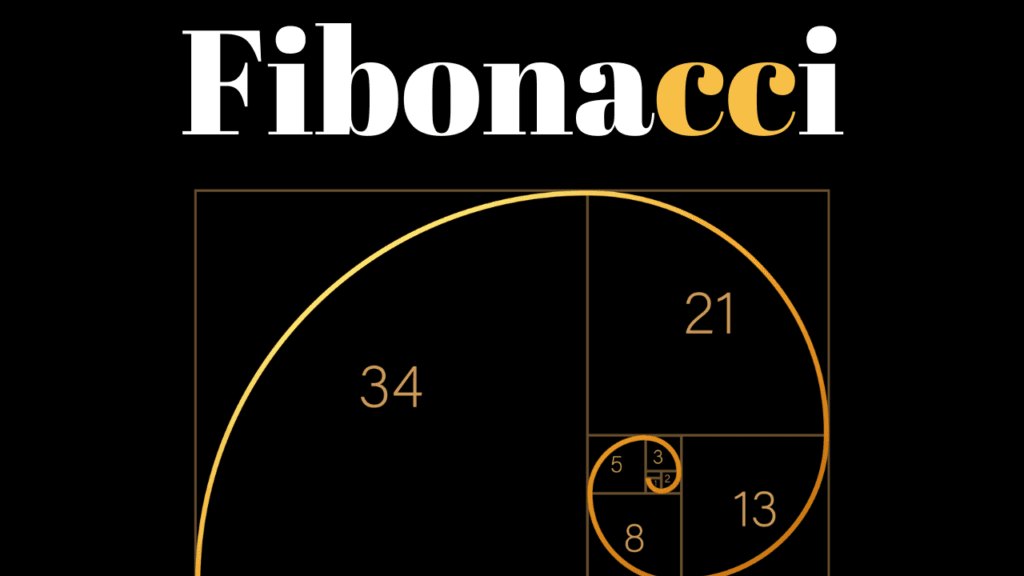

3. Use the 50/30/20 Rule

One of the simplest budgeting methods is the 50/30/20 rule. Here’s how it works:

- 50% of your income goes to necessities (like rent, utilities, groceries).

- 30% is allocated for wants (dining out, entertainment, shopping).

- 20% goes into savings or paying down debt.

This method is flexible and doesn’t require you to account for every single expense. Just categorize your spending, and make sure you’re sticking roughly to these percentages. It’s a great way to balance essential expenses, enjoyment, and savings.

4. Plan Your Meals and Groceries

Food expenses can add up quickly, especially if you frequently dine out or grab last-minute items at the store. Meal planning helps you avoid impulse purchases and save money by buying only what you need. Start by planning your meals for the week, making a shopping list based on that plan, and sticking to it when you’re at the store. This simple habit can help you cut down on food waste and save hundreds of dollars each year.

5. Try a No-Spend Day (or Week)

A no-spend day (or even a week) is a day where you commit not to spend any money outside of essential bills. Instead of going out, try to find free activities or make use of what you already have. For example, instead of dining out, cook a meal at home, or instead of buying new clothes, try restyling items you already own. No-spend challenges encourage creativity and help you recognize how much you can save when you cut back on unnecessary purchases.

6. Use Cash for Discretionary Spending

When you use cash, you tend to spend more mindfully because you can physically see your money leaving your hands. For categories like dining out, entertainment, or shopping, consider withdrawing a set amount in cash and only spending that amount. This approach is often called the “cash envelope system.” It’s a simple but effective way to limit spending because once your cash runs out, you’re done spending for that category until the next budget period.

7. Automate Your Savings

If saving money feels challenging, try automating it. Many banks offer an automatic transfer option that lets you set a specific amount to be transferred from your checking account to your savings account every month. Automating your savings means you’re paying yourself first without having to think about it, making saving a consistent and hassle-free habit. Start with an amount you’re comfortable with, even if it’s just $20 a month. Over time, you can gradually increase this amount as your budget allows.

8. Cut Down on Subscription Services

With so many subscription options available, it’s easy to lose track of what you’re paying for each month. Streaming services, monthly boxes, and app subscriptions can add up, even if each one doesn’t seem expensive on its own. Review your subscriptions and decide which ones you genuinely use and enjoy. Canceling even one or two services can free up money in your budget. Consider alternatives, like using free versions of apps or borrowing books from the library instead of paying for a book subscription.

9. Buy in Bulk (But Only for What You’ll Use)

Buying in bulk can save money on things you use frequently, like household supplies or non-perishable foods. Stores like Costco or Sam’s Club often offer lower prices per unit when you buy larger quantities. However, be careful not to overbuy, especially on items that have a short shelf life or that you don’t use regularly. Only buy in bulk for items you know you’ll use up, and always check that you have the storage space before making bulk purchases.

10. Review and Adjust Your Budget Regularly

A budget isn’t a one-time task; it’s an ongoing process. Every month, take a few minutes to review your budget and see how well you’re sticking to it. Adjust your spending limits if necessary, especially if you notice certain expenses are consistently higher than expected. Life circumstances change, so allow your budget to adapt as well. Regular reviews will keep you on track and help you catch overspending early.

Building a budget that helps you save money doesn’t have to be complicated. By following these budgeting hacks, you can manage your finances in a way that works for you and build a healthy savings habit. Remember, budgeting is all about finding a balance that allows you to enjoy life while still working toward your financial goals. Start small, stay consistent, and watch as your savings grow month by month!

- Simple Budgeting Methods You Should Know

- How to Save Money Each Month on Everyday Expenses

- Top Free Apps to Help You Track Your Spending

These extra resources offer more ideas to help you keep your finances on track and make budgeting even easier. Happy saving!

Thank you for reading! If you found these budgeting tips helpful, we invite you to explore more of our personal finance articles to deepen your knowledge and grow your financial skills. Head over to our main site at www.hunnier.com for more articles on saving strategies, debt management, and smart financial planning. There’s always more to learn about managing money, and we’re here to help!